The move came after US games retailer GameStop’s stock flooded in the midst of a mission to cause flexible investments huge misfortunes.

Mr Tenev denied “tricks” that he was attempting to help the mutual funds.

Rather he accused an interest that Robinhood give a $3bn (£2.2bn) security store at short notification.

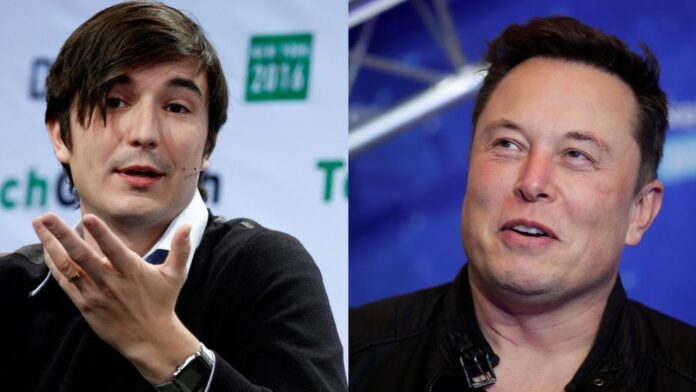

The meeting was directed on the sound just informal organization Clubhouse.

Mr Musk’s hour and a half appearance was a significant overthrow for Clubhouse, which is as of now in a “beta” testing stage and expects clients to be welcome to get to its foundation.

It permits individuals to join private spaces for discussions, yet members are covered at 5,000.

In any case, fans transferred the meeting on YouTube and flood rooms on the stage, as Mr Musk’s appearance pulled in uncommon consideration.

Mr Musk additionally talked about movement to Mars, Bitcoin and mind inserts during his meeting.

‘Democratizing access’

Robinhood checked purchasing of GameStop and some different offers a week ago.

In contrast to most exchanging stages, it doesn’t charge a commission for allowing clients to purchase and sell shares. Rather it brings in cash by selling information on those arrangements to others before they experience.

Some flexible investments have missed out on the ascent in GameStop’s offers since they had shorted the stock. This is the place where a financial specialist attempts to bring in cash by wagering an organization’s offer cost will fall.

Furthermore, Mr Musk addressed how much Robinhood was “indebted to” Citadel Securities, which is its greatest customer. Stronghold has endured misfortunes because of an interest in a mutual funds that had taken a huge short situation on GameStop.

Mr Musk has recently been disparaging of short offering, guaranteeing it to be a “lawful” trick.

Mr Tenev recognized that there had been “talk that Citadel or other market creators sort of compelled us into” putting limitation on exchanges, yet added the case was “simply bogus”.

“Robinhood represents, you know, democratizing admittance to stocks,” he said on Clubhouse.

“We need to give individuals the entrance… however we had no way out for this situation, we needed to adjust to our administrative capital prerequisites.”

Mr Musk asked accordingly: “Did you sell your customers down the waterway, or [did] you must choose between limited options?”

Mr Tenev rehashed that Robinhood needed to conform to monetary prerequisites.

He said this elaborate a request from the National Securities Clearing Corporation – a clearing house utilized by the organization – to give “around $3bn” to back up its exchanges. He added the interest was subsequently decreased to $700m.

Mr Tenev yielded, in any case, that Robinhood should have been more straightforward.

“We had the option to open and serve our clients,” he said, adding that Robinhood had raised more than $1bn inside 24 hours.

“At the point when we do open [on Monday]… we’ll have the option to sort of loosen up the severe position restricts that we put on these protections on Friday.”

‘Expansive acknowledgment’

Mr Musk likewise turned out on the side of Bitcoin, saying he thought it was on “the skirt of getting an expansive acknowledgment” by ordinary money.

The digital currency has flooded in an incentive as of late, however a few specialists say it is unpredictable and will crash soon.

“I ought to have at any rate gotten some Bitcoin eight years back,” Mr Musk said on Clubhouse.

“Discussion about being late to the gathering.

“I was a little dim witted there… yet I do now think Bitcoin is something to be thankful for – I am an ally of Bitcoin.”

The cost of one bitcoin transcended $34,000 on Monday morning, up from $33,000, following Mr Musk’s remarks.

Life on Mars

The SpaceX head likewise said human travel to Mars will be conceivable inside five-and-a-half years – and plot his vision to migrate a few people there from Earth.

-BBC